NEW CLIENT ONBOARDING

Jan 22, 2026

By

Sam

How to Reduce Customer Churn Rate Before Customers Show Risk Signals

Most B2B SaaS teams still treat customer churn as a renewal problem.

They wait for obvious warning signs like usage drops, missed QBRs, declining health scores, negative customer feedback, or an increasing churn rate before reacting.

By the time those signals appear, the outcome is rarely reversible. What looks like “sudden churn” is almost never sudden; it’s the result of issues quietly building across the customer base, long before teams can accurately predict the likelihood of churn.

It’s simply the first moment when high customer churn becomes visible.

In reality, churn doesn’t begin with dissatisfaction or disappointment.

Customer churn begins with execution drift.

That drift often starts weeks after the deal closes, long before any churn prediction model flags risk, long before a machine learning model attempts to predict churn, and long before a CSM labels an account as an at-risk customer.

The highest-retention SaaS companies don’t rely on late-stage save plays or heroic renewal efforts. They design their go-to-market execution to prevent customer churn before it happens.

This playbook explains how they do that and why most SaaS teams don’t.

Related Blog: Automate Client Onboarding: System and Customer Automation

Churn Starts With Drift, Not Disappointment

Understanding the Real Drivers of Customer Churn

Customers rarely wake up one morning and decide to stop using your product.

Instead, churn unfolds quietly, over time, through a series of small execution failures that individually feel harmless but collectively increase the likelihood of churn.

Here’s what that pattern often looks like inside a B2B SaaS customer account:

Momentum slows after the deal closes

Ownership becomes unclear across internal teams

Progress feels opaque to the customer

Value feels delayed, abstract, or “future-tense”

Internal confidence erodes without triggering alarms

From your internal dashboards, everything still looks acceptable. Usage may even be stable. The customer data doesn’t scream risk.

From the customer’s perspective, belief is slipping.

There are no escalations.

No angry emails.

No obvious indicators of customer churn.

Just a subtle emotional shift from “this is going to work” to “we’ll see how this goes.”

That emotional shift is the earliest and most dangerous signal in customer churn analysis, and it rarely shows up in analytics.

This is why churn feels sudden when it finally occurs. The customer’s likelihood to churn has been increasing quietly for weeks or months, while customer interaction declines, customer satisfaction erodes, and customer acquisition costs are already sunk.

Most churn retrospectives ask:

“What went wrong at renewal?”

High-retention teams ask a very different question:

“Where did execution first drift?”

That question determines whether churn becomes inevitable or preventable.

Why Health Scores and Churn Prediction Models Are Always Late

Most SaaS teams rely on health scores, usage analytics, or even sophisticated machine learning churn prediction models to understand churn risk.

Health scores answer one question reasonably well:

“Is this customer already unhappy?”

They fail at a much more important question:

“Is this customer quietly losing momentum?”

Across mid-market and enterprise SaaS organizations, execution-level signals appear 3–6 weeks before traditional churn prediction data reflects risk.

These signals are operational, subtle, and easy to rationalize away:

Onboarding tasks created but not completed

Meetings that end without decisions or owners

Stakeholders are gradually dropping off calls

Verbal agreement without follow-through

“We’re still aligning internally” is becoming a recurring explanation

None of these trigger alerts are in most customer churn prediction models.

None of them spike health scores.

None of them feels urgent in isolation.

But together, they tell a consistent story: progress is stalling.

By the time health scores turn yellow or red, the customer’s likelihood to churn is already high. At that point, retention becomes a negotiation rather than a continuation.

Health scores don’t predict churn.

They confirm churn after belief has already eroded.

This is why even advanced predictive models built on historical data often fail to predict churn. They analyze customer behavior only after momentum has already been lost, instead of tracking execution signals that show risk much earlier.

Related Blog: Customer Onboarding Playbook for Customer Success Managers

The Most Dangerous Moment in the Customer Lifecycle

Where Customer Churn Prediction Should Really Focus

For demo-led and high-touch SaaS companies, churn often begins between deal close and kickoff.

This is the most emotionally fragile moment in the entire customer journey and one of the least instrumented in most churn prediction strategies.

The customer has just committed:

Budget

Political capital

Internal credibility

They’ve justified the purchase internally. They’ve made promises upward and sideways. What they need immediately is reassurance that they made the right decision.

What they often experience instead:

Sales momentum disappears after the contract is signed

Days or weeks pass without clear next steps

Context lives in scattered CRM notes, inboxes, and slide decks

Onboarding starts without a shared definition of success

A Lived Execution Drift Moment

In one mid-market SaaS company, B2B onboarding slipped by three weeks, not because of incompetence or neglect, but because ownership lived across Sales notes, a CSM inbox, and a project document no one fully owned.

No alerts fired.

No one escalated.

Usage eventually ramped.

At renewal, the customer said:

“We never really got going.”

Nothing catastrophic happened.

No major failure occurred.

Customer churn occurred because execution drifted early and never fully recovered.

More than 55% of B2B SaaS customers cite poor onboarding or delayed time-to-value as the primary reason for churn. Not because the product didn’t work, but because execution failed to inspire confidence when it mattered most.

The 30–60–90 Day Window That Predicts Retention and Churn

Multiple churn analyses show that 60–70% of customer churn can be traced back to the first 90 days of the lifecycle, long before meaningful customer lifetime value is realized.

This window determines whether customers believe:

“This team knows what they’re doing”

“We made the right decision”

“Value is actually achievable here”

High-retention teams obsess over this period.

They track:

Time to first value (not just go-live)

Clear ownership on both sides

Stakeholder alignment across teams

Weekly, visible progress

Low-retention teams assume:

“The product will prove itself”

“CS will drive adoption over time”

“We’ll intervene if churn risk appears”

By the time churn risk appears, emotional disengagement has already occurred.

Customer retention is not won at renewal.

It’s won when customers decide whether to emotionally commit in the first 90 days.

Related Blog: Self-Service Onboarding: The Ultimate Guide on Self-serve

Early Customer Churn Signals Most Teams Miss

What Historical Customer Data to Predict Churn Often Ignores

If you want to predict customer churn before it happens, you must look beyond usage and sentiment.

The most reliable early indicators of churn are execution-based:

Onboarding milestones slipping by 1–2 weeks without escalation

Repeated rescheduling of working sessions

Champions attending meetings but not driving internal action

Customers consuming enablement content without implementation

Decisions consistently deferred to “next week”

Individually, these don’t look like churn.

Collectively, they increase the probability of churn dramatically.

Momentum, not usage, is the strongest predictor of long-term customer retention.

Customers don’t churn because they stop logging in.

They stopped logging in because progress stalled long before.

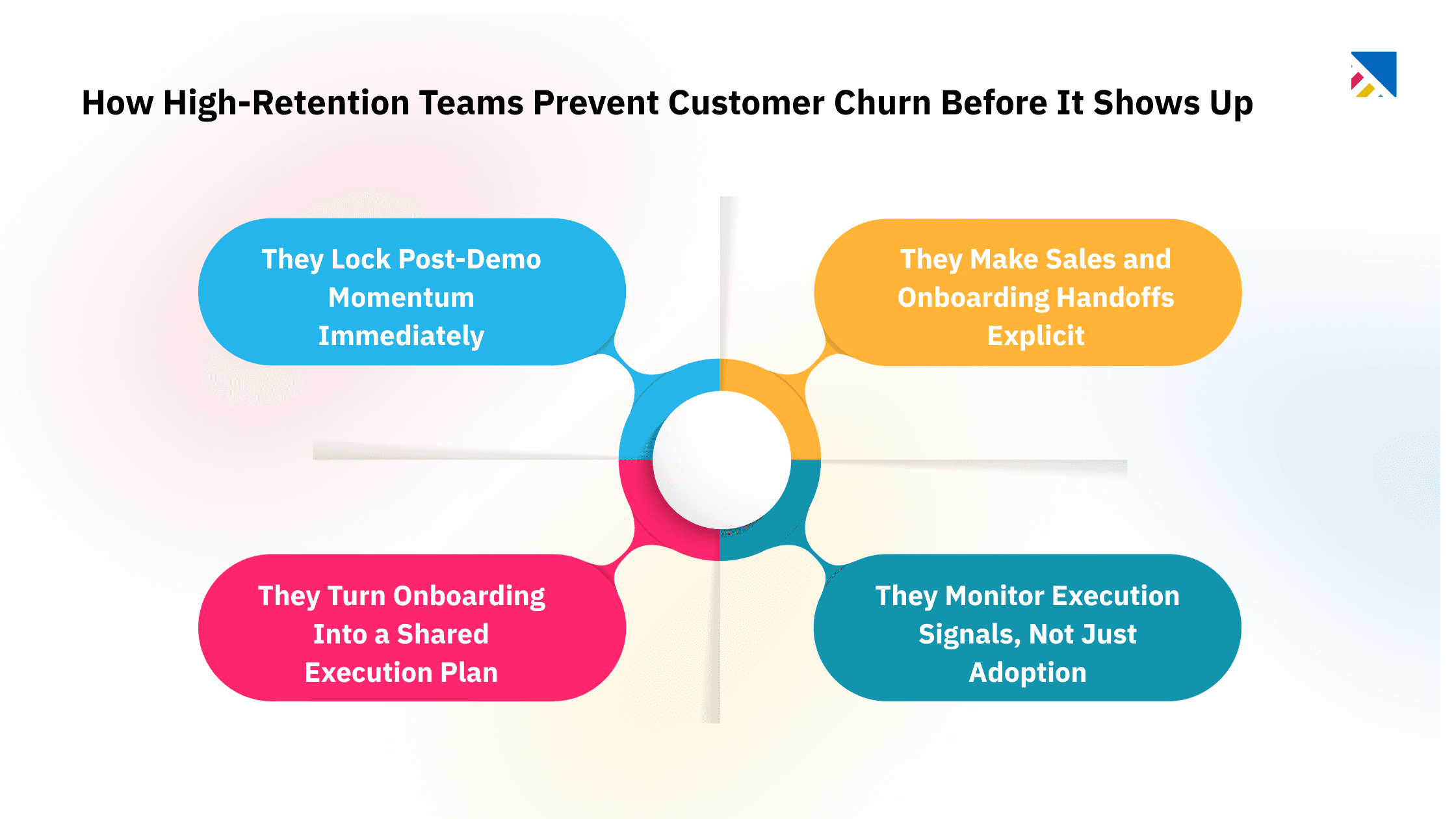

How High-Retention Teams Prevent Customer Churn Before It Shows Up

Preventing churn isn’t about more playbooks, more emails, or more reactive workflows. It’s about designing execution, so churn prediction becomes less necessary.

1. They Lock Post-Demo Momentum Immediately

High-retention teams treat post-demo momentum as part of delivery, not sales cleanup.

They:

Capture success criteria immediately after the deal

Assign ownership before kickoff

Make next steps visible to customers within 24–48 hours

This continuity reinforces confidence and reduces churn risk before it forms.

2. They Make Sales and Onboarding Handoffs Explicit

Most handoffs fail because they focus on logistics instead of outcomes.

High-retention teams ensure onboarding inherits:

Why the customer bought (in their own words)

What success looks like to each stakeholder

Timelines implied during sales conversations

Without this, customers feel like they’re starting over, and trust erodes.

3. They Turn Onboarding Into a Shared Execution Plan

Customers don’t churn because work isn’t happening.

They churn because progress is invisible.

High-retention teams make onboarding:

Visible to both sides

Clearly owned

Outcome-driven

Visibility creates control.

Silence creates anxiety.

Clarity is how you reduce customer attrition.

4. They Monitor Execution Signals, Not Just Adoption

Usage shows activity.

Execution shows momentum.

Top teams monitor:

Task velocity

Decision velocity

Stakeholder engagement consistency

Meeting-to-action conversion

This is the data most machine learning churn prediction models fail to capture.

What are the common methods or models used for customer churn prediction?

Traditional CS platforms were designed to observe customers, not to run execution.

They excel at:

Tracking usage

Scoring health

Reacting once churn risk appears

They struggle with:

Preserving post-demo momentum

Fixing broken handoffs

Exposing execution gaps early

Making progress visible to customers

Churn prevention now depends on a connected GTM execution layer, not just analytics that try to predict churn after a customer may have already lost momentum.

The Real Reframe: Customer Churn Is a GTM Execution Problem

Churn is rarely owned by CS alone.

It’s created by:

Broken handoffs

Fragmented workflows

Unclear ownership

Disconnected teams

High-retention rate companies reduce customer churn by fixing execution upstream across Sales, onboarding, CS, and delivery.

They don’t ask:

“How do we save this account?”

They ask:

“Where did momentum first break?”

That’s where customer churn prediction and prevention actually work.

Related Blog: A Guide to Customer Health Score Metric & How to Calculate It?

Frequently Asked Questions

1: What is the risk of churn, and how can it be identified early?

The risk of churn is the likelihood that an individual customer will cancel or stop using a product. Customer success teams identify customer churn risk early by tracking execution delays, declining engagement, and stalled onboarding signals that indicate a customer is likely to churn before usage drops.

2: What are the main types of churn, including involuntary churn?

The main types of churn include voluntary churn, when customers choose to leave, and involuntary churn, caused by payment failures or contract issues. Understanding each type of churn helps teams reduce a high churn rate and protect their overall retention rate.

3: How does churn risk vary across customer segments?

Churn risk differs across customer segments. SMB customers churn faster, while enterprise churn often results from slow execution rather than product usage. Effective churn prediction requires analyzing churn at the individual customer level to deliver an improved customer experience.

4: What causes a high churn rate, and how can companies improve customer retention?

A high churn rate is usually driven by poor onboarding, unclear ownership, and delayed value realization. Improving customer retention requires proactive customer success engagement, visible progress, and early intervention when customer churn risk appears.

5: How can customer success teams identify customers likely to churn?

Customers likely to churn often show early signs like missed milestones or low stakeholder engagement. Customer success teams can reduce churn by acting on these signals early and addressing issues before disengagement occurs.

Final Takeaway: Reduce Customer Churn Before It Looks Like Churn

If B2B onboarding regularly slips

If customers stall without escalation

If CS only reacts once churn risk appears

Then, customer churn has already started.

The best time to reduce churn is before churn prediction models light up.

If your churn analysis starts at renewal, you’re already too late.

See where momentum breaks in your post-demo onboarding flow. Request a demo

You may also like

A Guide to Project Management Professional Certification

Jun 18, 2025

Laugh Your Way to Productivity: 50 Workplace Quotes

Jun 18, 2025

50 Funny Workplace Memes That’ll Brighten Your Workday.

Jun 18, 2025

What Does a Customer-First Mindset Mean? Explained in 2025

Nov 3, 2025

What It Takes to be a Great Customer Success Manager in 2025

Aug 11, 2025

Resolve Common Customer Complaints into Powerful Experiences

Nov 4, 2025