Project Management

Digital Sales Room

Feb 10, 2026

By

Sam

Early Warning Signs That Your Deal Is Slipping: How to Spot Deal Slippage Before It's Too Late

The Hidden Cost of Deal Slippage in Your Sales Pipeline

Here's a scenario that keeps revenue leaders up at night: Your sales team has been nurturing a six-figure enterprise deal for four months. The prospect seemed engaged. Your champion was enthusiastic.

The demos went well. Then suddenly the deal slips. Follow-ups go unanswered. Meetings get postponed indefinitely. By the time you realize the deal is slipping away, your competitor has already signed the contract.

According to Gartner, 77% of B2B buyers describe their latest purchase as extremely complex or difficult. This complexity creates countless opportunities for deal slippage to occur without warning.

The average enterprise deal now involves 6-10 decision makers, takes 3-9 months to close, and requires navigation through shifting priorities, budget constraints, and internal politics.

The difference between consistently hitting quota and constantly explaining pipeline gaps often comes down to one critical skill: recognizing the warning signs of deal slippage before momentum is irreversibly lost.

Enterprise deals rarely die overnight. They slip away gradually, one missed call at a time, one postponed meeting after another. The most successful sales reps don't just react to obvious red flags; they develop systems to prevent deal slippage by detecting the subtle shifts in buyer behavior early in the process.

Related Blog: Where Are Your Enterprise Deals Losing Momentum?

Why Preventing Deal Slippage Matters More Than Your Sales Forecast

When sales teams fail to manage deal slippage effectively, the costs compound quickly.

According to Salesforce's State of Sales Report, only 28% of sales professionals' time is spent actually selling; the rest is consumed by administrative tasks, internal meetings, and chasing slipped deals that should have been qualified out weeks ago.

The math is brutal: If your average deal size is $150,000 and your sales team spends three months on a deal showing clear warning signs, that's roughly $46,000 in fully-loaded sales costs. Multiply that across a team, and you're looking at hundreds of thousands in wasted investment annually.

Deal slippage doesn't just impact individual quota attainment; it wreaks havoc on your sales forecast. When committed deals fail to close by their projected close date, leadership makes strategic decisions based on inflated pipeline projections.

This leads to missed revenue targets at the end of the quarter, resource allocation errors, reduced forecast accuracy that undermines credibility with stakeholders, and increased pressure on your sales team to make up shortfalls.

Book a demo today to see how you can eliminate these risks before they compound.

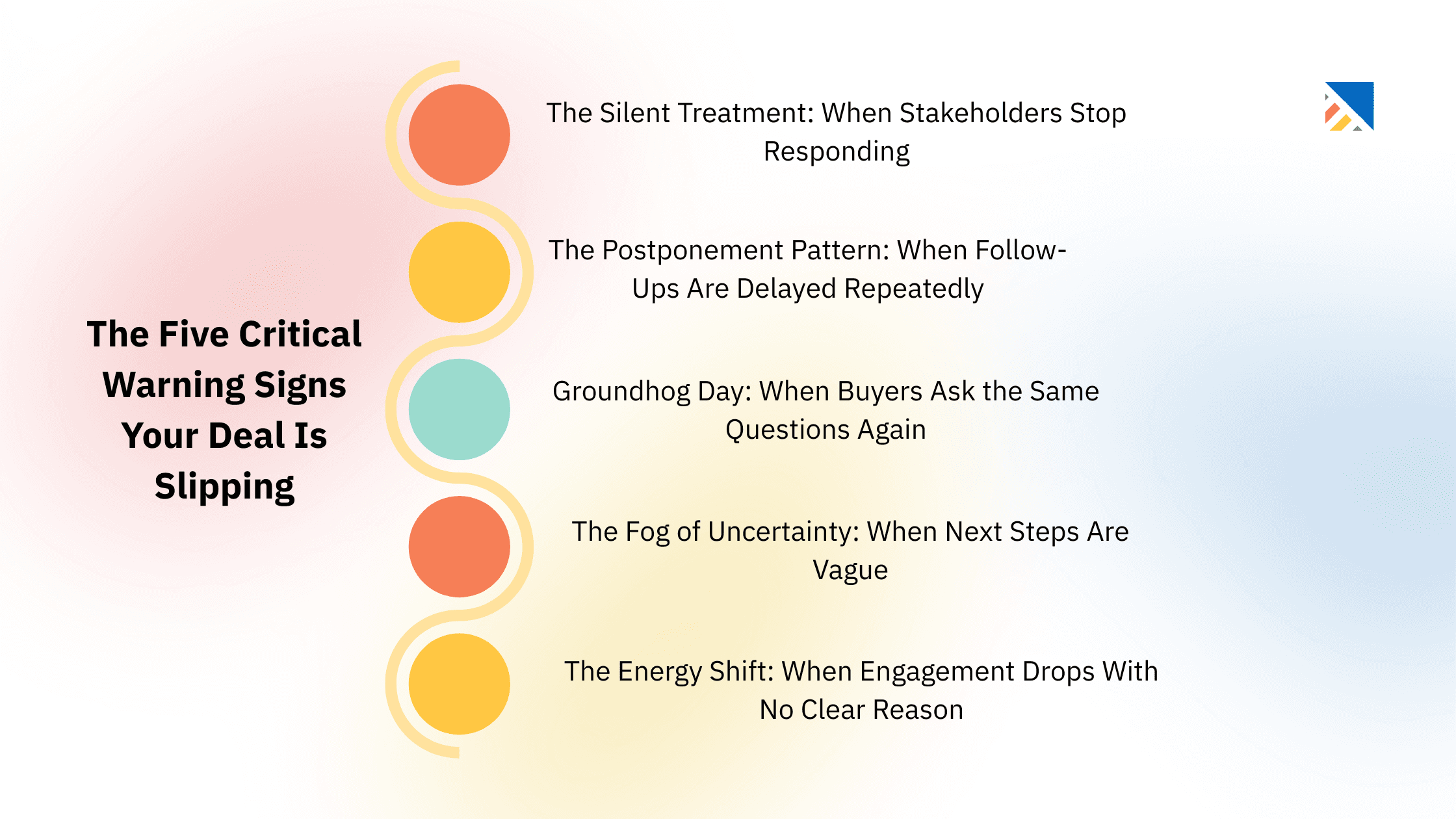

The Five Critical Warning Signs Your Deal is Slipping

Warning Sign 1 - The Silent Treatment: When Stakeholders Stop Responding

The most obvious yet frequently ignored sign your deal is slipping is the communication blackout. Your primary contact, who previously responded within hours, now takes days or doesn't reply at all.

What it looks like: Email responses stretch from hours to days to never. Phone calls roll to voicemail without callbacks. Slack or Teams messages show "seen" but no response.

What it actually means: This silence rarely indicates your contacts simply forgot about you. In B2B enterprise sales, people don't forget six-figure purchasing decisions.

When stakeholders go dark, deal slippage occurs because they've lost internal support, budget priorities have shifted, a competitor has gained the upper hand, or your champion has lost political capital.

How to respond: Pick up the phone and address the elephant in the room: "I notice our communication has slowed significantly. What's changed on your end?" Or use the permission-based breakup: "I want to be respectful of your time. Should we pause this conversation for now?"

Warning Sign 2 - The Postponement Pattern: When Follow-Ups Are Delayed Repeatedly

In healthy deals, follow-up meetings happen as scheduled. There's natural momentum and clear deal progression. When your sales deal starts showing signs of trouble, you'll notice continuous postponements: Monday becomes Wednesday, Wednesday becomes "sometime next week," and next week becomes "we'll circle back when things settle down."

What it actually means: Your deal has lost its urgency, and deals stall when they lack a compelling event.

According to CSO Insights, 60% of forecast deals end in "no decision", not because buyers chose a competitor, but because they chose to do nothing at all. This pattern directly impacts your sales forecast and forecast accuracy, especially as you approach the end of the quarter when these delays become critical.

How to respond: Reestablish urgency: "What's changed since we last spoke about solving [specific pain point]?" Create a mutual action plan with shared timelines and concrete milestones.

Related Blog: Digital Sales Room (DSR): A Guide to Virtual Deal Rooms.

Warning Sign 3 - Groundhog Day: When Buyers Ask the Same Questions Again

There's a peculiar phenomenon in slipped deals where stakeholders begin asking questions you've already answered, sometimes multiple times. You find yourself re-explaining integration capabilities, revisiting pricing structures, or re-demonstrating features.

What it actually means: This repetition is one of the clearest signs your deal is experiencing slippage because the buying committee has expanded without your knowledge, your champion is fielding objections from decision makers they haven't introduced you to, or internal confusion exists about your solution's value proposition and ROI.

Research from Forrester shows that 92% of the buyer's journey happens before a prospect ever contacts a vendor. When questions regress instead of progress, it suggests the buying process has stalled or reversed, a key indicator that deal slippage is occurring.

How to respond: Map the full buying committee: "It sounds like new stakeholders are involved. Can we schedule a broader session?" Document everything in your CRM and track which decision-maker asked what questions and when.

Warning Sign 4 - The Fog of Uncertainty: When Next Steps Are Vague

In every strong enterprise deal, there should be crystal clarity about what happens next. Each conversation should end with concrete commitments: specific dates, defined outcomes, and clear ownership. This is essential for maintaining forecast accuracy and preventing deals that slip.

When deal slippage begins, this clarity evaporates with statements like "Let's touch base sometime next week" (When? With whom? About what?), "I'll get back to you once I've discussed this internally" (With whom? By when?), or "We'll circle back after things settle down" (What's the trigger?).

What it actually means: Vague next steps indicate your contacts lack authority, urgency, consensus, or budget. This is where proper qualification early in the sales process pays dividends.

How to respond: Call it out professionally: "I notice we've been less specific about next steps lately. Has something shifted that we should discuss openly?" Use a mutual action plan tracked in your CRM to improve sales visibility and reduce deal slippage across your pipeline.

Warning Sign 5 - The Energy Shift: When Engagement Drops With No Clear Reason

Beyond specific behaviors, there's an intangible quality to deal health that experienced sales professionals learn to feel. The energy changes. This subtle shift is often the earliest warning sign that slippage occurs, even before other signals become apparent.

Track these quantifiable metrics in your CRM: response time trends (has average reply time increased by 50%+ over two weeks?), email engagement (are open rates and click-through rates declining?), and meeting acceptance rates (what percentage of invited stakeholders actually join?).

These metrics help make slippage visible to your sales team during regular pipeline reviews, allowing you to reduce slippage before it's too late.

How to respond: Be direct: "I want to be candid about what I'm observing. Our engagement has shifted noticeably over the past few weeks. Can we talk honestly about whether this is still the right priority for your organization?" This transparency demonstrates confidence and surfaces hidden objections.

Book a demo to see how these early warning signals can be tracked automatically, before intuition turns into a missed quarter.

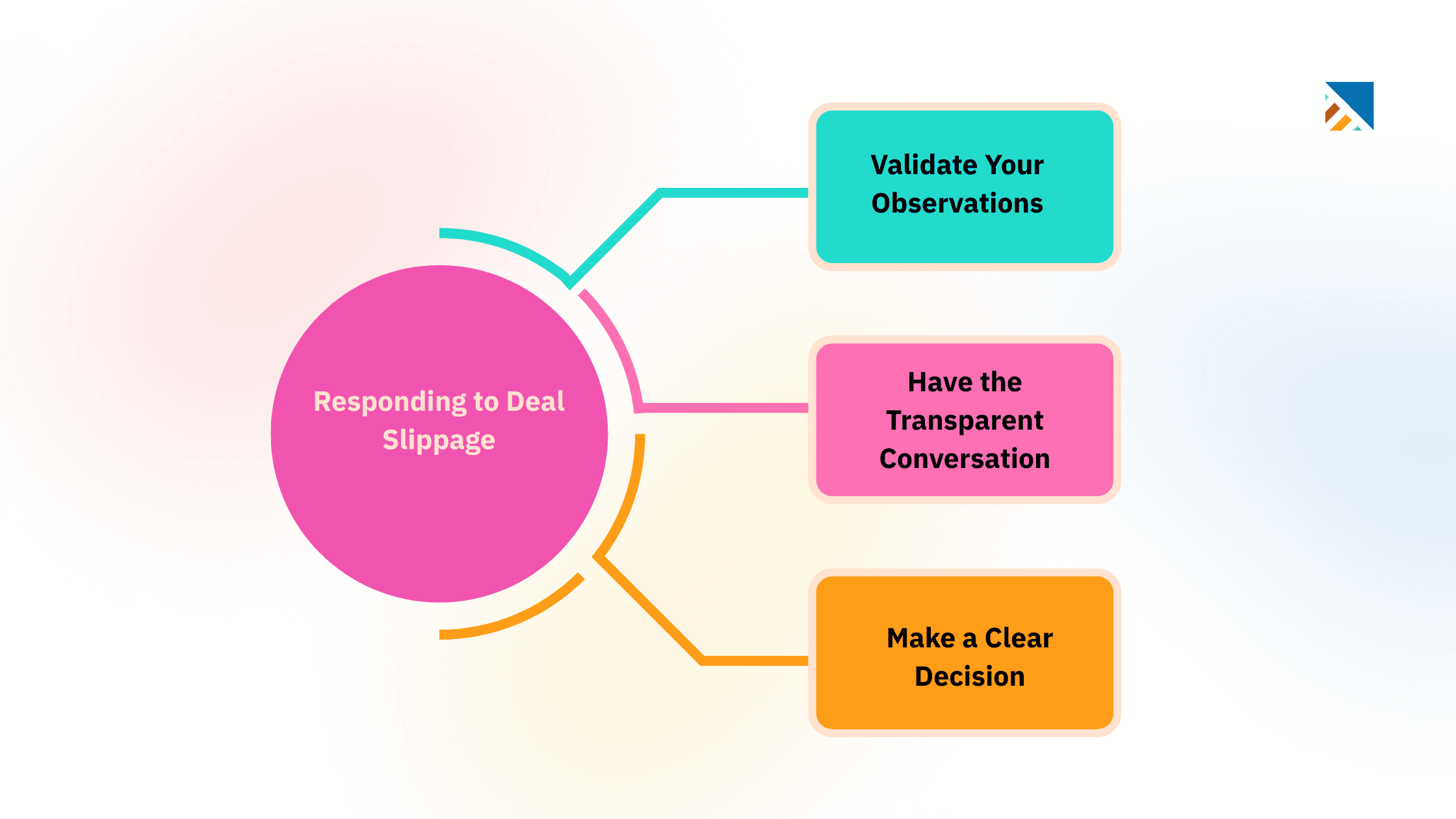

What to Do When You Spot Warning Signs of Deal Slippage

Recognizing warning signs is only valuable if you act on them decisively. Here's your response playbook to reduce deal slippage:

Step 1: Validate Your Observations

Compare current engagement to baseline metrics in your CRM. Review the past 2-3 weeks of interactions objectively during pipeline reviews. Check whether external factors explain the shift.

Step 2: Have the Transparent Conversation

Use this template: "[Name], I want to be respectful of your time and transparent about what I'm observing. Over the past few weeks, I've noticed [specific behaviors]. This suggests that either the timing isn't right, priorities have shifted, or there are concerns we haven't addressed. Can we have an honest conversation about where things actually stand?"

Step 3: Make a Clear Decision

Based on what you learn, choose one of three paths: Re-engage by addressing the root issues and building a new action plan with an updated close date; Pause by agreeing to revisit when timing improves and adjusting your forecast accordingly; or Close-lost by respectfully exiting and freeing up capacity for better opportunities.

Sales teams that actively disqualify poor-fit deals increase win rates by 15-20% by focusing energy on committed deals with a higher likelihood of closing.

Strategies to Prevent Deal Slippage Before It Starts

The best way to manage deal slippage is to prevent it from happening in the first place. Strong qualifications and a disciplined sales process are your first line of defense.

Use MEDDIC for enterprise deals to improve forecast accuracy:

Metrics: What economic impact and ROI are they seeking?

Economic Buyer: Who controls the budget?

Decision Criteria: How will they choose between options?

Decision Process: What steps must happen before signature?

Identify Pain: Is the problem urgent and expensive?

Champion: Who will sell internally when you're not there?

According to EBSTA’s 2025 Sales Qualification Report, well-qualified deals are 6.3x more likely to close and close 21.6% faster than poorly qualified ones. Proper qualification not only boosts win rates but also dramatically improves your ability to predict which deals will close and maintain forecast accuracy.

Set expectations from the first conversation on timeline and procurement process expectations, and on mutual commitment: "If we invest time building a custom proposal, what would you need to see to move forward?"

These questions surface misalignment early in the process, when it's easiest to address and before deal slippage can take root.

Contact us to help your team surface risk early and keep deals moving forward.

When to Walk Away from Slipped Deals

Not every sales deal deserves your energy. Some lost deals should be accepted. The opportunity cost of nurturing deals that slip is the high-probability opportunities you're neglecting. Understanding when to walk away is critical to maintaining healthy slip rate metrics and sales performance.

Walk away when you've had the honest conversation and root issues remain unresolved, timeline keeps pushing right with no concrete trigger event, budget has been reallocated with no clear path back, or multiple attempts to close deals have failed.

According to Sales Hacker, top performers disqualify 30-50% of their pipeline proactively, focusing energy on deals they can actually close. This discipline is essential to reduce slippage overall and hit sales targets consistently.

Building Systems to Improve Sales Forecast Accuracy

Build signal detection into your regular cadence to improve sales performance across your team through regular pipeline reviews:

Weekly deal reviews: Has engagement increased, stayed flat, or decreased this week? Are we on track with the mutual action plan and the close date? Have any warning signs emerged?

Monthly pipeline reviews: What percentage of deals are showing 2+ warning signs of deal slippage? Which deals have been in the same stage for 2+ weeks beyond normal sales cycles? Where are we seeing the most slippage in our sales funnel? How does our current slip rate compare to previous quarters?

These regular pipeline reviews create accountability and visibility, helping your entire sales team recognize patterns and reduce deal slippage systematically.

Related Blog: Best Digital Sales Room Software: B2B Strategies That Win

Conclusion: Turning Deal Slippage Into a Competitive Advantage

In enterprise sales, the difference between consistently hitting sales targets and explaining away pipeline gaps often comes down to vigilance. The deals you save through early detection are often more valuable than the new ones you source.

The warning signs we've explored, such as stakeholders going silent, repeated postponements, recycled questions, vague next steps, and declining engagement, rarely appear in isolation. They compound. Understanding how deal slippage occurs and what triggers it gives your sales team the power to intervene before it's too late.

Your competitive advantage is in noticing warning signs before your competitors do, having systems to prevent deal slippage built into your sales process, possessing the courage to address issues directly with stakeholders, and maintaining forecast accuracy through disciplined pipeline reviews.

The sales professionals who develop systems for early warning detection, frameworks for transparent conversations, and the discipline to disqualify poor-fit opportunities don't just close more deals. They close them faster, with less stress, and with stronger customer relationships.

By focusing on these strategies to prevent deal slippage, you'll not only improve sales performance but also build more accurate forecasts, reduce your slip rate, and create predictable revenue streams that drive business growth.

Start paying attention to the warning signs of deal slippage today. Your sales pipeline and your quota will thank you.

Start a free trial and turn early warning signs into on-time, predictable wins.

You may also like

A Guide to Project Management Professional Certification

Jun 18, 2025

Laugh Your Way to Productivity: 50 Workplace Quotes

Jun 18, 2025

50 Funny Workplace Memes That’ll Brighten Your Workday.

Jun 18, 2025

What Does a Customer-First Mindset Mean? Explained in 2025

Nov 3, 2025

What It Takes to be a Great Customer Success Manager in 2025

Aug 11, 2025

Resolve Common Customer Complaints into Powerful Experiences

Nov 4, 2025